free cash flow yield s&p 500

For more information on how our historical price data is adjusted see the Stock Price Adjustment Guide. The table below includes fund flow data for all US.

S P 500 Sectors Free Cash Flow Yield Through 4q20 New Constructs

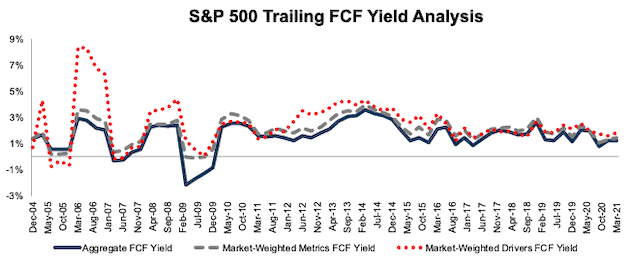

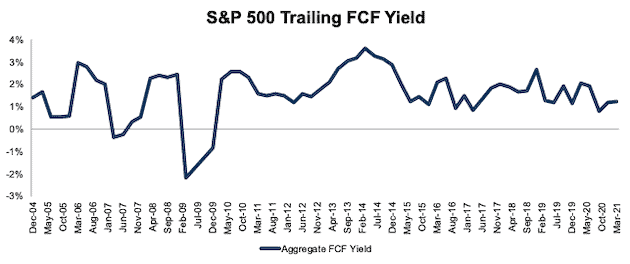

SP 500 Trailing Free Cash Flow Yield Free cash flows can be expressed as a valuation measure in the form of a free cash yield when they are divided by price.

. Ad Open a New Savings Account in Under 5 Min. Investors who wish to employ the best fundamental. For example you can use high free cash.

There are many ways to do it. Only sector leaders exhibiting both high dividend yield and free cash flow yield are included in the index. The SP 500 is expensive according to most valuation metrics but appears attractively valued on free cash flow yield due to reduced capex investment Kostin said.

The trailing FCF yield for the SP 500 rose from 11 at. Free cash flow yield offers investors or stockholders a better measure of a companys fundamental performance than the widely used PE ratio. To break it down free cash flow yield is determined first by using a companys cash flow statement.

SP 500 DIVIDEND AND FREE CASH FLOW YIELD INDEX TR. Listed Highland Capital Management ETFs. This report is an abridged version of SP 500 Sectors.

Historical price to free cash flow ratio values for SP Global SPGI since 2006. The trailing FCF yield for the SP 500 rose from 11 at the end of 2020 to 16 as of 51921 the earliest date 2021 Q1 data was provided by all SP 500. This report analyzes free cash flow enterprise value and the FCF yield for the SP 500 and each of its sectors.

On the trailing twelve months basis SP 500 s pace of Free Cash Flow growth in 4 Q 2021 decelerated to 535 year on year but remained above average. You can also combine other metrics such as dividend yield to further shortlist the stocks. Cash Flow Statement A cash flow Statement contains information on how much cash a company generated and used during a given period.

One is to take all the SP500 stocks calculate their Free Cash Flow Yield and either pick the top 10-20 stocks or take stocks having a yield above certain percentage suhas 10 yield. SP 500 FCF Yield Falls to Lowest Level Since December 2009. The SP 500 Dividend and Free Cash Flow Yield Index is designed to measure the constituents of the SP 500 that exhibit both high dividend yield and sustainable dividend distribution characteristics while maintaining diversified sector exposure.

Price data is as of 32321. Designer491iStock via Getty Images. In this report our research is based on the latest audited financial data which is the 2020 10-K for most companies.

Free Cash Flow growth YY Annual Comment. Historically the equity market free cash yield on trailing free cash flow has averaged around 45. Sequentially cumulative Free Cash Flow fell by -36.

Free Cash Flow Yield Through 2Q21 one of the reports in our quarterly series on fundamental market. SP 500s current Price to Cash flow ratio has decreased due to shareprice contraction of -777 from beginning of the forth quarter and due to the sequtial cash flow for the trailig twelve month period contraction of -9488 to Pcf of 1381 from average the Price to Cash flow ratio in the third quarter of 1460. Free cash flow yield is a financial solvency ratio that compares the free cash flow per share a company is expected to earn against its market value per share.

Start Maximizing Your Interest Today. The recently launched SP 500 Dividend and Free Cash Flow Yield Index combines dividend yield and free cash flow yield in the constituent selection process. This report analyzes free cash flow enterprise value and the trailing FCF yield for the SP 500 and each of its sectors.

Around 25 of the time it has been below 36 and. Total fund flow is the capital inflow into an ETF minus the capital outflow from the ETF for a particular time period. Compare Open an Account Online Today.

SP 500 FCF Yield Rebounds In Q1 2021. This report analyzes free cash flow FCF enterprise value and the trailing FCF yield for the SP 500 and each of its sectors. The ratio is calculated by taking.

The index has demonstrated an attractive yield level strong tilt to value. Beurskoers grafieken koersen beursadviezen financiële gegevens analyses en real time nieuws van de index SP 500 DIVIDEND AND FREE CASH FLOW YIELD INDEX TR USA. This appendix shows the two drivers used to calculate FCF yield free cash flow and enterprise value for the SP 500 and each SP 500 sector going back to December 2004.

Free cash flow yield is really just the companys free cash flow divided by its market value. FCF yield for the SP 500 fell from 18 at the end of 2019 to 08 through 2Q20 or its lowest level since December 2009. The following table presents historical return data for ETFs tracking the SP 500 Dividend and Free Cash Flow Yield Index.

Grow Your Savings with the Most Competitive Rate.

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

Free Cash Flow And Dividends How A Focus On Yield Can Help Investors Provide For Today And Prepare For Tomorrow Library Insights Manning Napier

/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

S P 500 Sectors Free Cash Flow Yield Through 4q20 New Constructs

The S P 500 Median Price To Free Cash Flow Ratio Is Now 34 66 Seeking Alpha

Price To Free Cash Flow Backtest Fat Pitch Financials

Free Cash Flow And Dividends How A Focus On Yield Can Help Investors Provide For Today And Prepare For Tomorrow Library Insights Manning Napier

/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)